I would hope they wouldn't think that, but the use of the term "selling" in the industry implies just that, a sale, not a license. I was only pointing out that difference as the point that was being made was that it was doing harm to the future of the company by selling content to other providers. When in fact, it was a non-exclusive licensing deal (just like the Star Wars to TBS deal that I referenced above). It really isn't a big deal and I"m not sure why a certain poster made it one.Right, nobody would have thought Star Wars was sold to Warner. Not what you see about that that changes my point.

HBO Max/Discovery+ Merger

- Thread starter ncted

- Start date

- Latest activity Latest activity:

- Replies 756

- Views 96K

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Nov 29, 2003

- 17,666

- 23,188

Give it up, even posted the link that said selling, does not matter, just wants to argue, while ignoring the entire point of the post.Right, nobody would have thought Star Wars was sold to Warner. Not what you see about that that changes my point.

Which is studios selling/licensing the rights to their programming, instead of keeping them exclusive to their streaming services for short term cash, due to their high debt load.

Netflix has proven if you do not do that, it will pay off in the end.

The deal Disney signed with Warner was to start in 2016, 3 years before Disney+ launch date, it was for the first 6 films and the future ( at the time) sequels ( when it was time to air after Pay 1), Netflix at the time had Pay 1 ( first run after PPV) status, Warner's TBS/TNT would of been Pay 2.When in fact, it was a non-exclusive licensing deal (just like the Star Wars to TBS deal that I referenced above). It really isn't a big deal and I"m not sure why a certain poster made it one.

Netflix deal for Pay 1 films ended in 2018.

Disney's deal with Warner ends in 2024, after that, only on D+ except Netflix still holds the rights to the "Pay 2" window for Disney movies released between between 2016 and 2018 including Infinity War, Star Wars: The Force Awakens and Coco, but these wouldn't become available to Netflix until after 2025.

That makes total sense! Smart licensing deals.The deal Disney signed with Warner was to start in 2016, 3 years before Disney+ launch date, it was for the first 6 films and the future ( at the time) sequels ( when it was time to air after Pay 1), Netflix at the time had Pay 1 ( first run after PPV) status, Warner's TBS/TNT would of been Pay 2.

Netflix deal for Pay 1 films ended in 2018.

Disney's deal with Warner ends in 2024, after that, only on D+ except Netflix still holds the rights to the "Pay 2" window for Disney movies released between between 2016 and 2018 including Infinity War, Star Wars: The Force Awakens and Coco, but these wouldn't become available to Netflix until after 2025.

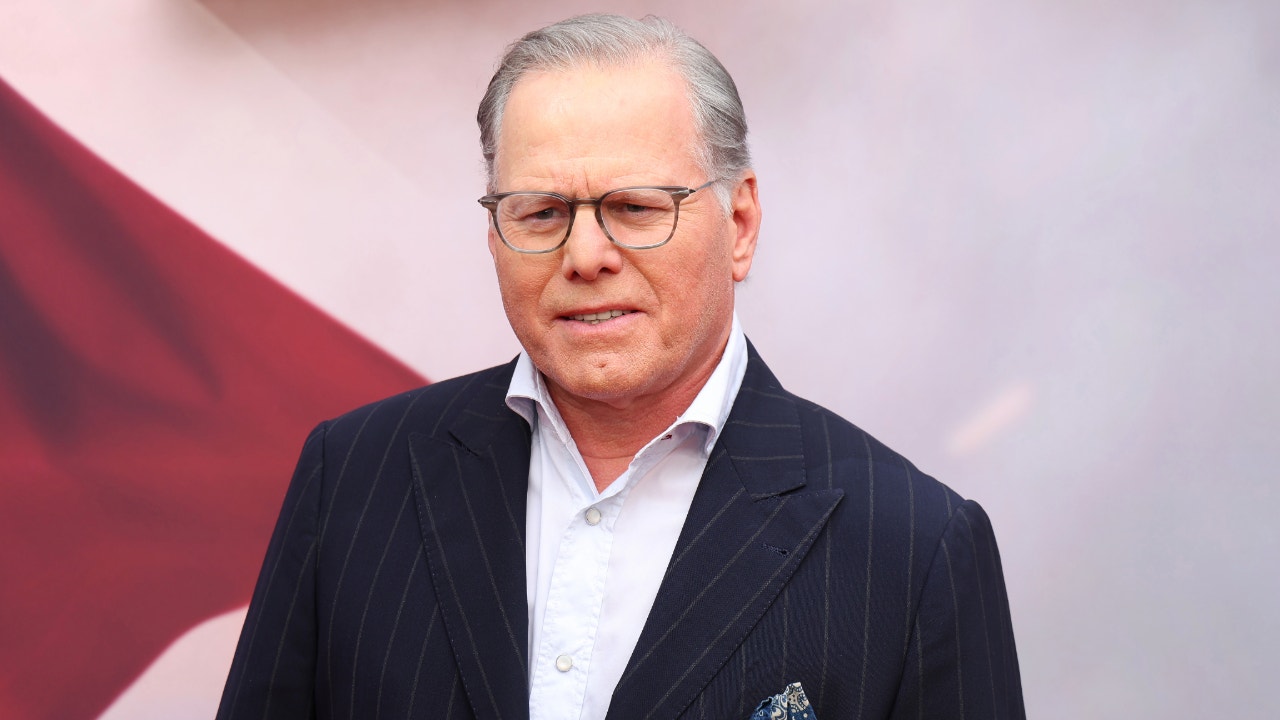

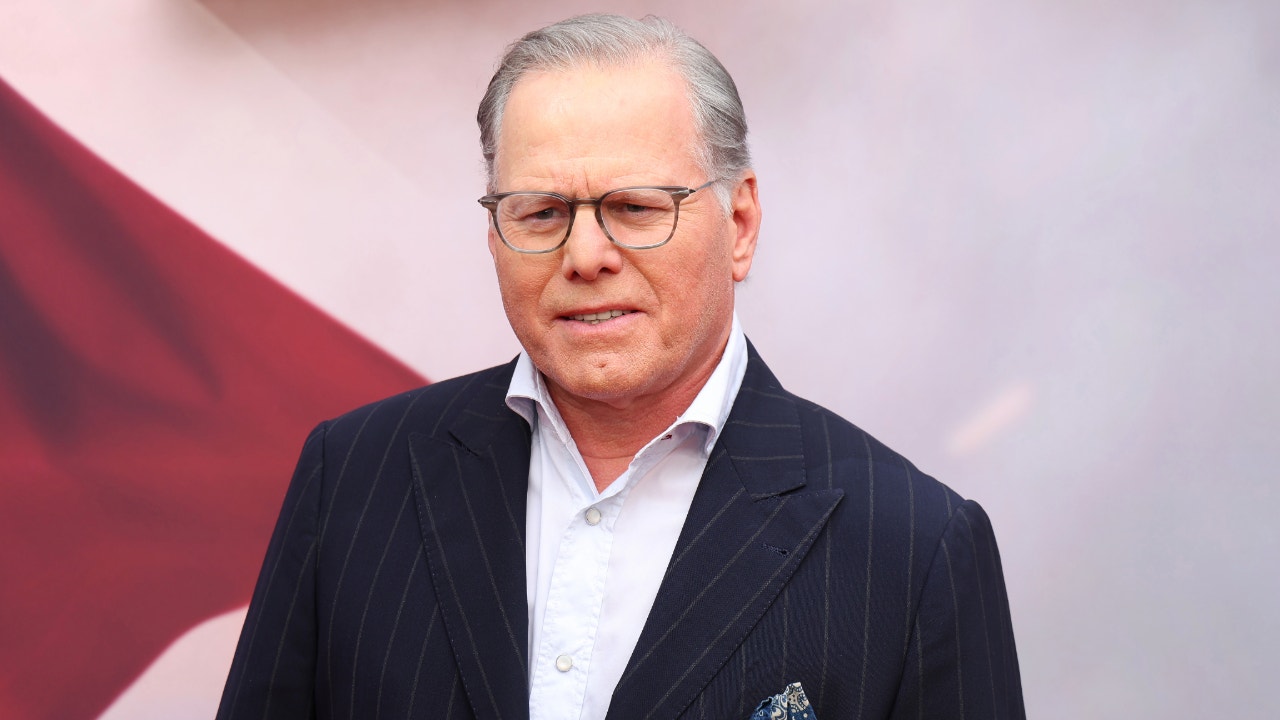

Warner Bros. Discovery and Paramount Global Have Held Meeting to Discuss Possible Merger

WBD CEO David Zaslav and Paramount CEO Bob Bakish met in New York this week.

One by one they are all merging or reassembling just like cable. So much for streaming freedom. Before long there will be 4 main streamers and it will cost you just as much as before with forced cable packs if you want to subscribe to them.

Yep. I'm already paying as much monthly for streaming as the TV portion of my Xfinity bill. I expect it will get worse next year with the new employment contracts in place.

One by one they are all merging or reassembling just like cable. So much for streaming freedom. Before long there will be 4 main streamers and it will cost you just as much as before with forced cable packs if you want to subscribe to them.

Largely expected, we don't know what the new normal looks like for streaming OR traditional services at this point. Streaming can never be a mirror of what we saw the traditional services become though, because there are 10s of millions who will just do without. It's not a market that can be recaptured again with a single style of service.

So until things stabilize, we'll see fluctuations one way or the other.

Additionally, we'll never see the successful return of things like 2 year contracts without sufficient incentives. Long gone are the days of trapping people in contracts to secure things like hardware costs. DirecTV Stream sure is trying though.

- Nov 29, 2003

- 17,666

- 23,188

I really doubt that, specially since Broadcast Channels/RSNs fees will be about $40 next month, then you have that extra $10 in fees ( FCC, Franchise, just because you are a customer of Comcast fee), Box fee(s), then the programing cost.Yep. I'm already paying as much monthly for streaming as the TV portion of my Xfinity bill.

For, roughly, the same amount of just those fees, over at least $50 ( do not know how many boxes you have), you could get Hulu w Disney/ESPN+, Paramount+ w/Showtime, Peacock for $50.

Then if you add MAX at $20, AMC+ at $9, you would get the vast majority of what is on Paid Live TV, all the streaming shows/movies, all in at least 1080P, a lot in 4K, even live feeds of certain channels, plus mostly Commercial Free.

I wonder how much that Comcast bill would be with HBO and Showtime added in.

- Nov 29, 2003

- 17,666

- 23,188

Still not happening-

Warner Bros. Discovery and Paramount Global Have Held Meeting to Discuss Possible Merger

WBD CEO David Zaslav and Paramount CEO Bob Bakish met in New York this week.www.hollywoodreporter.com

Warner Bros. Discovery CEO Zaslav not ready to make deal for Paramount but options remain on table

The purchase of Shari Redstone’s stake in National Amusements and Paramount would make it easier for David Zaslav to start to absorb the media company.

This is crazy. It seems almost like the merger that created The CW TV network in 2006...on steroids!Still not happening-

Warner Bros. Discovery CEO Zaslav not ready to make deal for Paramount but options remain on table

The purchase of Shari Redstone’s stake in National Amusements and Paramount would make it easier for David Zaslav to start to absorb the media company.www.foxbusiness.com

I hope the FTC investigates this monopolistic attempt and shuts down the Paramount-Warner merger!

- Nov 29, 2003

- 17,666

- 23,188

Warner is back getting tax write offs that some posted here they were not getting-

Warner Bros. Pictures abruptly shelved the completed project in November for a $30 million tax write-off, suffering a major backlash both online and amongst the film community for the decision.

www.darkhorizons.com

www.darkhorizons.com

Warner Bros. Pictures abruptly shelved the completed project in November for a $30 million tax write-off, suffering a major backlash both online and amongst the film community for the decision.

New Photo From "Coyote vs. Acme"

Eric Bauza, the Emmy winning voice over artist who currently voices multiple Looney Tunes characters, has shared a first look photo from “Coyote vs. Acme”. Warner Bros. Pictures abruptly shelved the completed project in November for a $30 million tax write-off, suffering a major backlash both...

I'm not going to explain again, but give it a rest. Neither you nor the author of that article understand taxes.Warner is back getting tax write offs that some posted here they were not getting-

Warner Bros. Pictures abruptly shelved the completed project in November for a $30 million tax write-off, suffering a major backlash both online and amongst the film community for the decision.

New Photo From "Coyote vs. Acme"

Eric Bauza, the Emmy winning voice over artist who currently voices multiple Looney Tunes characters, has shared a first look photo from “Coyote vs. Acme”. Warner Bros. Pictures abruptly shelved the completed project in November for a $30 million tax write-off, suffering a major backlash both...www.darkhorizons.com

- Nov 29, 2003

- 17,666

- 23,188

Well, here is Steven Chung, who is a tax attorney in Los Angeles, California.I'm not going to explain again, but give it a rest. Neither you nor the author of that article understand taxes.

He explains it.

By shelving the movie, WB will write off $72 million from its income with means it will save $15.1 million in federal taxes.

Was The 'Coyote vs. Acme' Movie Canceled For Tax Purposes? - Above the Law

Studios generally do not make movies just lto create tax write-offs. Wile E. Coyote had no comment. The Road Runner was traveling and unavailable for comment at press time.

Dude - They would have gotten that tax deduction over the depreciable life of the film anyway. It is all a timing issue. I don't know who Steven Chung is, but he is either a very bad tax attorney or he is being intentionally deceptive. There is no other explanation.Well, here is Steven Chung, who is a tax attorney in Los Angeles, California.

He explains it.

By shelving the movie, WB will write off $72 million from its income with means it will save $15.1 million in federal taxes.

Was The 'Coyote vs. Acme' Movie Canceled For Tax Purposes? - Above the Law

Studios generally do not make movies just lto create tax write-offs. Wile E. Coyote had no comment. The Road Runner was traveling and unavailable for comment at press time.abovethelaw.com

But that is tax they don't have to pay now, so they can use it to pay down debt or invest in something new. Having the money now is (likely) worth more to them than getting the depreciation over time. There is a benefit to the company, if not to all parties involved.Dude - They would have gotten that tax deduction over the depreciable life of the film anyway. It is all a timing issue. I don't know who Steven Chung is, but he is either a very bad tax attorney or he is being intentionally deceptive. There is no other explanation.

- Nov 29, 2003

- 17,666

- 23,188

Again, you are answering more then a wrote, all I posted was, from a article, they are still getting Tax Write Offs, then I post something from a Tax Attorney, which you are not, then insult him without knowing who he is and how good at his job he might be.Dude - They would have gotten that tax deduction over the depreciable life of the film anyway. It is all a timing issue. I don't know who Steven Chung is, but he is either a very bad tax attorney or he is being intentionally deceptive. There is no other explanation.

According to just a quick search, has his own firm, been doing this since 2006, went to Loyola Law School.

then this

Steven Chung, Author at Above the Law

Steven Chung is a tax attorney in Los Angeles, California. He helps people with basic tax planning and resolve tax disputes. He is also sympathetic to people with large student loans. He can be reached via email at stevenchungatl@gmail.com. Or you can connect with him on Twitter (<a...

Absolutely a timing/cash flow benefit. Albeit a minor one. But it is not as portrayed in the multiple posts that this is an additional tax write-off. It is not. It is just an acceleration of the depreciation of the asset (for which the cash has already been paid). There is no company in their right mind that would do these write-offs for the tax benefit (as is being portrayed by these articles and this poster). It is because the content sucked and they determined that it shouldn't be released because they would hurt the brand or because it wasn't worth spending the associated marketing money to generate very limited revenue.But that is tax they don't have to pay now, so they can use it to pay down debt or invest in something new. Having the money now is (likely) worth more to them than getting the depreciation over time. There is a benefit to the company, if not to all parties involved.

It sounds fun and flashy to say they wrote it off for the tax benefit, but that isn't really what is happening.

- Nov 29, 2003

- 17,666

- 23,188

Absolutely a timing/cash flow benefit. Albeit a minor one. But it is not as portrayed in the multiple posts that this is an additional tax write-off. It is not. It is just an acceleration of the depreciation of the asset (for which the cash has already been paid). There is no company in their right mind that would do these write-offs for the tax benefit (as is being portrayed by these articles and this poster).

And the Tax Attorney.

Yes, the tax attorney who is either a bad tax attorney or is intentionally trying to mislead people. Correct. There is literally no other alternative.And the Tax Attorney.

- Nov 29, 2003

- 17,666

- 23,188

Yes, the tax attorney who is either a bad tax attorney or is intentionally trying to mislead people. Correct. There is literally no other alternative.

Similar threads

- Replies

- 2

- Views

- 197

- Replies

- 1

- Views

- 491

- Replies

- 20

- Views

- 1K

- Replies

- 100

- Views

- 6K

Users Who Are Viewing This Thread (Total: 0, Members: 0, Guests: 0)

Who Read This Thread (Total Members: 227) Show all

- ncted

- Dave90000

- Bruce

- lakebum431

- dhpeeple1

- gms49ers

- ahurst21

- catamount

- user3162

- savarese04

- MikeD-C05

- llokey

- brice52

- phlatwound

- Foxbat

- Elsguy

- KAB

- hwkn

- meStevo

- gpg

- mc6809e

- Dell00iss

- MartyDe

- osu1991

- Bobby

- David Ortiz

- navychop

- RaiderPower

- jorgek

- b4pjoe

- klang

- johnr475

- MrMars

- DS0816

- red30

- metzmda

- odbrv

- glrush

- AZ.

- Ronnie-

- SDA_FL_USA

- Keith Brannen

- harshness

- Scott Greczkowski

- TazMan258

- bcwmachine

- randycat

- larryk

- zippyfrog

- spiderman865

- Howard Simmons

- thomasjk

- gjc

- ronman

- N5XZS

- AntiMoz

- jimgoe

- mrc54

- Phil T

- stargate5

- dlwilkes45