To each his own! It was an inexpensive option to get some great channels that we enjoyed. We are not out anything other than the cost of our four receivers (which were all purchased at half price other than one) and they are still useful for our OTA tuning. Other than how they ended things it was a pleasant experience and we were very pleased with their service.I would not have touched Orby with a 3 meter pole, this is why, it was always going to happen.

Orby has gone dark!

- Thread starter bornpatriot

- Start date

- Latest activity Latest activity:

- Replies 48

- Views 9K

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I wonder if BestBuy knew. If they had their receiver clearance knowing that OrbyTV was going out of business it's disgraceful

Best Buy store closings 2021: More closures expected as leases up (usatoday.com)

It's called "insider trading". People have worn orange jumpsuits over this.I wonder if BestBuy knew. If they had their receiver clearance knowing that OrbyTV was going out of business it's disgraceful.

Worked great for me! The STB ended up costing a WHOPPING $3.96 per month. It was a good investment that met my viewing needs in both the office and occassional use while camping in the RV. An innovative pay as you go satellite based service that had a niche customer base.

RIP Orby! It was good while it lasted...

RIP Orby! It was good while it lasted...

That is not insider trading. I am not condoning it if true but it is not insider trading.It's called "insider trading". People have worn orange jumpsuits over this.

"insider trading" is in quotes; that is what I call it. While technically not related to securities, the principle is the same. Someone (Orby, and possibly Best Buy) was privy to inside information that they exploited to gain financial advantage over an unsuspecting entity (person). Had this information been generally known and available, some would not have bought equipment, that was known by the vendor/supplier in advance to be worthless. Maybe not your definition, but a distinction without a difference. While the $100 I spent for useless equipment isn't going to alter my lifestyle, still pees me right off.That is not insider trading. I am not condoning it if true but it is not insider trading.

I thought Orby was a great concept. No contract, pay as you go, affordable etc. I wonder if we will ever know what happened to them. I was going to sign up. I guess this is one case of my procrastination being a good thing.

Agree, Orby was a great concept, I enjoyed their programming, but not the way they ended it.I thought Orby was a great concept. No contract, pay as you go, affordable etc. I wonder if we will ever know what happened to them. I was going to sign up. I guess this is one case of my procrastination being a good thing.

LOL, I would like to see "Mystery at Blind Frog Ranch", "Homestead Rescue", or "Moonshiners".I would like to see a class action lawsuit

Well it was fun while it lasted......and the damn recievers are probably door stops. On a good note I now have $55 a month freed up to pay for a 5G gateway, the Slimline can be parked on another bird like 99w, I might get grandma and grandpa's old dish unless they want me to pipe in some FTA religous programming. If I can obtain a BUD that will legally get me 90% of what I wanna watch........

Here is the difference----if they knew about the Orby situation but sold Orby equipment etc. They are not guilty of the crime you voted and not subject to the serious penalties that go with it."insider trading" is in quotes; that is what I call it. While technically not related to securities, the principle is the same. Someone (Orby, and possibly Best Buy) was privy to inside information that they exploited to gain financial advantage over an unsuspecting entity (person). Had this information been generally known and available, some would not have bought equipment, that was known by the vendor/supplier in advance to be worthless. Maybe not your definition, but a distinction without a difference. While the $100 I spent for useless equipment isn't going to alter my lifestyle, still pees me right off.

Or 1998Seems like May 1st 2005 all over again.

Now all the Orby people know how it was like to be a Voomer.

Sent from my iPhone using Tapatalk

P R I M E S T A R

I suspect the Orby folks were working hard right to the end on securing the needed financing to continue. While it would have been much better if subscribers had advance notice of the potential failure, I'm sure Orby was hoping to the last minute that the notice wouldn't be needed. I don't know if a last minute deal was in the works and fell through or not, but that might account for the no notice until it was over...

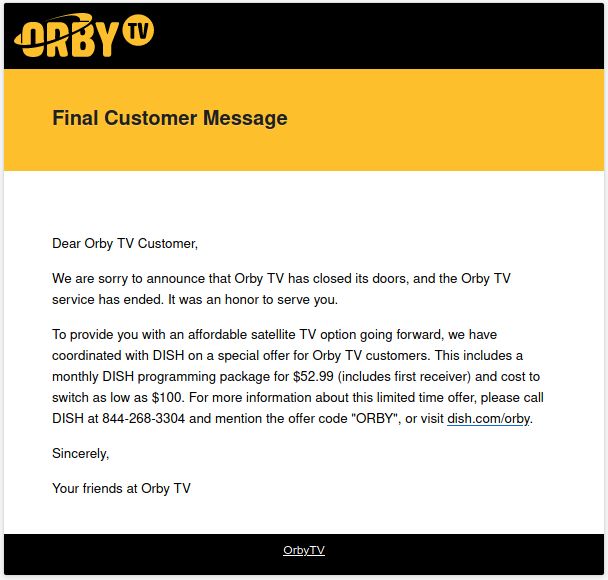

Well, I got an email from Orby telling us their service has ended - guess we didn't know that already when the channels went dark.  Anyway it basically restates what is on their website but it was nice that they provided that one last bit of personal interaction with a customer, even if it was a bit late.

Anyway it basically restates what is on their website but it was nice that they provided that one last bit of personal interaction with a customer, even if it was a bit late.

Anyway it basically restates what is on their website but it was nice that they provided that one last bit of personal interaction with a customer, even if it was a bit late.

Anyway it basically restates what is on their website but it was nice that they provided that one last bit of personal interaction with a customer, even if it was a bit late.Or AlphaStar 07/96 - 09/97Or 1998

P R I M E S T A R

I wonder if BestBuy knew. If they had their receiver clearance knowing that OrbyTV was going out of business it's disgraceful.

Doesn't Best Buy allow returns. I would think that customers that just recently bought Orby receivers but could not activate them would be able to get a full refund on their purchase.

Sent from my iPhone using SatelliteGuys

I had Primestar till January of 1997. We had an ice storm then that caused our power to brown out over and over till the receiver started smoking and then Poof! Dead receiver. That's when the service guy came out with another box and told me about a new company called Dish network. We went the next day and looked at the service at a dealership and then signed on for DISH . That was over 24 years ago. I liked that the menus had color as opposed to the black and white menus and guides with Primestar. We also got our super stations with DISH so we could keep watching Star Trek Voyager. Our local CBS station quit showing it . So in all we have had satellite service for 25 years when you combine both Primestar satellite service with DISH's satellite service.Actually I think Primester didn't go dark till late 1999

Sent from my iPhone using Tapatalk

Hey friend I believe dave acquired primestarI had Primestar till January of 1997. We had an ice storm then that caused our power to brown out over and over till the receiver started smoking and then Poof! Dead receiver. That's when the service guy came out with another box and told me about a new company called Dish network. We went the next day and looked at the service at a dealership and then signed on for DISH . That was over 24 years ago. I liked that the menus had color as opposed to the black and white menus and guides with Primestar. We also got our super stations with DISH so we could keep watching Star Trek Voyager. Our local CBS station quit showing it . So in all we have had satellite service for 25 years when you combine both Primestar satellite service with DISH's satellite service.

I did my first install of a former Orby customer who told me they had shut down. That's a shame to see an up and comer go out of business

Similar threads

- Replies

- 12

- Views

- 11K

- Replies

- 2

- Views

- 2K

- Replies

- 8

- Views

- 4K

- Replies

- 15

- Views

- 5K

- Replies

- 1

- Views

- 2K