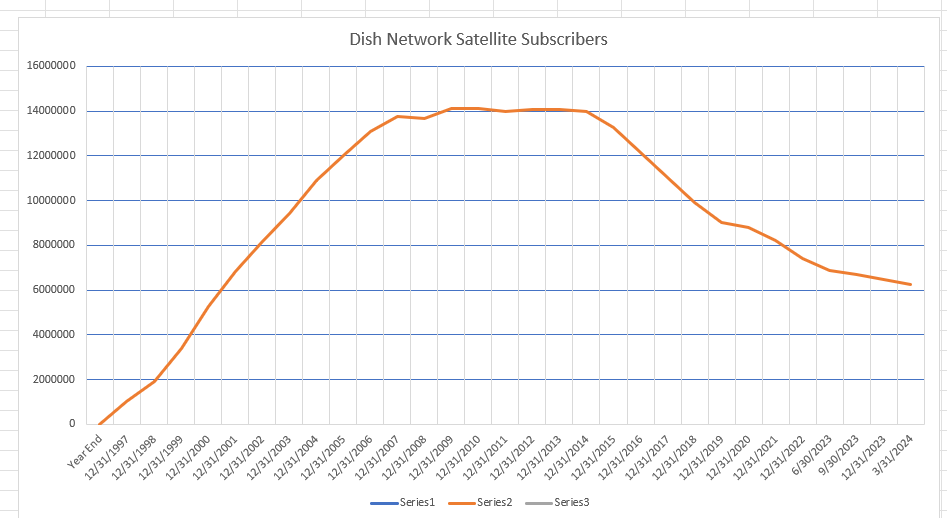

updated the satellite subscriber graph. The rate of subscriber loss is flattening.

EchoStar/Dish raises doubts about 'ability to continue as a going concern'

- Thread starter MitchDeerfield

- Start date

- Latest activity Latest activity:

- Replies 991

- Views 88K

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

updated the satellite subscriber graph. The rate of subscriber loss is flattening.

View attachment 171288

They're still losing north of 200k a quarter.

- Nov 29, 2003

- 16,655

- 21,458

updated the satellite subscriber graph. The rate of subscriber loss is flattening.

View attachment 171288

Last year they lost 945,000 Dish and 279,000 Sling subscribers.They're still losing north of 200k a quarter.

That is a 1,224,000, so a average of 306,000 a quarter

First Quarter 2024 was Sling lost 135,000, DISH lost 213,000 subscribers

So first quarter was 348,000, so 42,000 higher then last year's average.

- Nov 29, 2003

- 16,655

- 21,458

I believe they can if the 75% build out is not completed next year, but that is about it.Can the government not seize the spectrum due to non use?

Total debt is over $19 Billion, Total Liabilities is $37 Billion.

from here-

EchoStar Total Liabilities 2010-2024 | SATS

EchoStar total liabilities from 2010 to 2024. Total liabilities can be defined as the total value of all possible claims against the corporation. <ul style='margin-top:10px;'> <li>EchoStar total liabilities for the quarter ending December 31, 2024 were <strong>$40.693B</strong>...

- Nov 29, 2003

- 16,655

- 21,458

And more info-

"Because we do not currently have committed financing to fund our operations for at least twelve months … substantial doubt exists about our ability to continue as a going concern," EchoStar said in the 10-Q. "We do not currently have the necessary cash on hand and/or projected future cash flows to fund fourth quarter operations or the November 2024 debt maturity."

This part tell me they have given up on a investor and begging those who hold the debt-

CEO Hamid Akhavan said the company is working on a number of avenues to refinance its obligations and improve its cash position. "We have fielded a variety of offers and are pursuing those which can support our long term objectives," he told investors on May 8. "The complex and delicate nature of this process demands time and confidentiality. We will certainly have more to share in due course."

"Candidly, can we push the maturities out? We're very bullish about our prospects of our operating business if we have the capital to execute," Akhavan said. "While we're working on that financing, we're not sitting on our hands and letting opportunities expire. We continue to develop them, so hopefully post-challenges on financing, we will have a good business to go forward."

Akhavan told investors that he sees significant asset value on the balance sheet, relative to the company's liabilities. He estimated that company's spectrum ownership is worth "far more than the value of the obligations we have." He said EchoStar is working to capitalize on the value of its asset to debt and turn it into liquidity to execute the company's business.

The problem with the above is Dish/Echostar cannot do anything till 2026 and they need someone they will want what they are offering.

Telecommunications analyst Craig Moffett said in a research note on Wednesday that filing for bankruptcy in the next four to six months is now "the most likely outcome" for EchoStar.

And while EchoStar's spectrum is "enormously valuable," Moffett said that likely buyers AT&T, Verizon, and T-Mobile do not look to be in a position to spend aggressively on new spectrum. Moffett noted that both AT&T and Verizon have investment grade credit ratings, but have debt-to-EBITDA leverage ratios that are above investment grade guidelines. Both have also teased share repurchases.

"The intrinsic value of Dish's assets in a bankruptcy liquidation is inarguably very high. Whether they could fetch anything like intrinsic value, however, is less clear," Moffett wrote. "There are only three potential bidders, two of whom have badly overburdened balance sheets. There is no longer Dish itself as the marginal bidder. And the time value of money is a real consideration; a liquidation would potentially take a very long time. In fact, it's not even clear that spectrum sales of any size would be allowed."

www.satellitetoday.com

www.satellitetoday.com

"Because we do not currently have committed financing to fund our operations for at least twelve months … substantial doubt exists about our ability to continue as a going concern," EchoStar said in the 10-Q. "We do not currently have the necessary cash on hand and/or projected future cash flows to fund fourth quarter operations or the November 2024 debt maturity."

This part tell me they have given up on a investor and begging those who hold the debt-

CEO Hamid Akhavan said the company is working on a number of avenues to refinance its obligations and improve its cash position. "We have fielded a variety of offers and are pursuing those which can support our long term objectives," he told investors on May 8. "The complex and delicate nature of this process demands time and confidentiality. We will certainly have more to share in due course."

"Candidly, can we push the maturities out? We're very bullish about our prospects of our operating business if we have the capital to execute," Akhavan said. "While we're working on that financing, we're not sitting on our hands and letting opportunities expire. We continue to develop them, so hopefully post-challenges on financing, we will have a good business to go forward."

Akhavan told investors that he sees significant asset value on the balance sheet, relative to the company's liabilities. He estimated that company's spectrum ownership is worth "far more than the value of the obligations we have." He said EchoStar is working to capitalize on the value of its asset to debt and turn it into liquidity to execute the company's business.

The problem with the above is Dish/Echostar cannot do anything till 2026 and they need someone they will want what they are offering.

Telecommunications analyst Craig Moffett said in a research note on Wednesday that filing for bankruptcy in the next four to six months is now "the most likely outcome" for EchoStar.

And while EchoStar's spectrum is "enormously valuable," Moffett said that likely buyers AT&T, Verizon, and T-Mobile do not look to be in a position to spend aggressively on new spectrum. Moffett noted that both AT&T and Verizon have investment grade credit ratings, but have debt-to-EBITDA leverage ratios that are above investment grade guidelines. Both have also teased share repurchases.

"The intrinsic value of Dish's assets in a bankruptcy liquidation is inarguably very high. Whether they could fetch anything like intrinsic value, however, is less clear," Moffett wrote. "There are only three potential bidders, two of whom have badly overburdened balance sheets. There is no longer Dish itself as the marginal bidder. And the time value of money is a real consideration; a liquidation would potentially take a very long time. In fact, it's not even clear that spectrum sales of any size would be allowed."

EchoStar Continues to Shed Subscribers Amid Cash Crunch, Analyst Predicts Bankruptcy

EchoStar Corporation reported an 8.5% revenue decline in the first quarter of 2024 compared to the prior year, with subscriber declines in pay-TV, retail

www.satellitetoday.com

www.satellitetoday.com

and local newsLive TV? Why? Sports?

And those apps have commercials that are unskippable.They have apps for that.

Watching a cable news program during the afternoon.Live TV? Why? Sports?

IF DISH doesn't meet the 75% deadline to build out their cell phone company in June of next year they can lose all the spectrum that they have paid for up to now. But they need lots of money to finish the build out of the towers in rural areas, so it all comes back to money. I don't see them meeting the deadline. Maybe a renegotiate with the FCC before the deadline?Can the government not seize the spectrum due to non use?

- Nov 29, 2003

- 16,655

- 21,458

It is not just rural areas, they still have three areas to do that are definitely not rural, including a really big metro area that will cost a lot to finish-IF DISH doesn't meet the 75% deadline to build out their cell phone company in June of next year they can lose all the spectrum that they have paid for up to now. But they need lots of money to finish the build out of the towers in rural areas, so it all comes back to money. I don't see them meeting the deadline. Maybe a renegotiate with the FCC before the deadline?

Future Planned Areas:

| Boston, MA Charleston, WV | Los Angeles, CA |

Learn About the Boost Mobile Network

Boost Mobile offers a nationwide 5G network with 99% coverage, leveraging AWS for enhanced connectivity and compatibility with most devices.

Meanwhile, Echostar/Dish stock was up today to $15.75, where its been for almost two years. The stock market is more accurate than some financial guru who is possibly shorting the stock and hoping to drive it into bankruptcy.

In other words, the market doesn't believe Moffett's predictions are accurate.

In other words, the market doesn't believe Moffett's predictions are accurate.

- Nov 29, 2003

- 16,655

- 21,458

Dish Stock price was in the $40 range just three years ago, 10 years ago, it hit a high of $79 in 2014, so no, $15 is not good.Meanwhile, Echostar/Dish stock was up today to $15.75, where its been for almost two years. The stock market is more accurate than some financial guru who is possibly shorting the stock and hoping to drive it into bankruptcy.

In other words, the market doesn't believe Moffett's predictions are accurate.

But you are correct, the market is a good indicator, but that is still not good news for Dish.

Watching a cable news program during the afternoon.

Really the only reason I still have Dish. I work from home and the TV is on cable news all day in the background on mute unless something earth shattering happens. Have a Wally with OTA adapter so I pay zero fees and nothing for locals, which is the only reason it makes sense to keep it.

For like when RFK says a worm ate part of his brain and then died in there?

For like when RFK says a worm ate part of his brain and then died in there?

Sandy Hook and 1/6 are two memorable news events I recall disrupting my work day.

My general rule is when Scott pours out the gasoline and torches the web board on fire, that is the time to panic on Dish. But according to Dish's SEC filings, not some financial guru, but what Dish itself is saying, things are not looking great.Meanwhile, Echostar/Dish stock was up today to $15.75, where its been for almost two years. The stock market is more accurate than some financial guru who is possibly shorting the stock and hoping to drive it into bankruptcy.

In other words, the market doesn't believe Moffett's predictions are accurate.

Indeed, $16 a share is still not that bad, based on the news Dish is providing, which means some might believe Dish will pull this off or that it at least has a revenue stream and Dish can survive a bit longer in a shifted form.

- Nov 29, 2003

- 16,655

- 21,458

Depends on what metrics you are using, will the stock continue to lose value or is there a chance it will gain back the losses.Indeed, $16 a share is still not that bad, based on the news Dish is providing, which means some might believe Dish will pull this off or that it at least has a revenue stream and Dish can survive a bit longer in a shifted form.

Based on their filing, there is no chance it will gain back what it has lost in the last couple of years, a loss of $25 per share .

When a companies' only hope is a miracle investor, I would stay away from buying shares.

Dish needs about $20 Billion to pay off debt coming due this year and the 2 years after and to continue the build out, which has to be finished by next year.

And that build out is not for just rural areas, but LA, Boston and Charleston, which are not done (or started?) yet.

Just LA will be close to the billion dollar range if not more.

Users Who Are Viewing This Thread (Total: 0, Members: 0, Guests: 0)

Who Read This Thread (Total Members: 494) Show all

- MitchDeerfield

- RadioNW

- satjay

- tvinsider

- brittanygarden

- wa6rht

- logdog

- dgschoel

- easathor

- iKramerica

- jamesjimcie

- odbrv

- Ray_Clum

- Paul289

- tallfence

- gms49ers

- gmitchell

- MikeD-C05

- TBK

- Juan

- brice52

- cfunk

- GPM

- Yespage

- Foxbat

- Elsguy

- REB

- ClarkGable

- loubon

- pamajestic

- Almighty1

- mc6809e

- msbehavin

- Jim5506

- tjboston5676

- starsh87

- SlicerMDM

- dsimmon9

- Dell00iss

- Nominal

- Cold Irons

- syphix

- dhunter113

- primestar31

- WALLYWOMBAT

- AkaDoubleG

- ewindowman

- navychop

- nelson61

- johnr475

- RobMeyer1

- njack11

- klang

- meStevo

- gjc

- rvvaquero

- strikes2k

- dweber

- osu1991

- llokey

- Joe The Dragon