Douglas-based giant may gain Atlanta Braves. Experts say a deal could set the stage for ex-owner Ted Turner to get involved with the team again.

Liberty Media Corp.'s possible jump into sports ownership could last much longer than its foray into the business six years ago when it bought and sold the Colorado Avalanche, Denver Nuggets and Pepsi Center within a month.

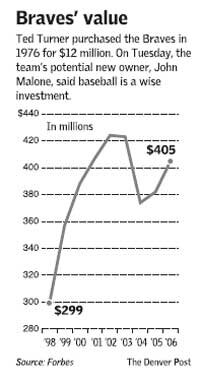

The Douglas County-based company is reportedly negotiating to acquire baseball's Atlanta Braves as part of a complex asset swap with the team's owner, Time Warner.

To avoid taxes, Liberty would have to hold onto the Braves for two years, according to corporate tax experts.

If so, it also raises an intriguing question: could former Braves owner Ted Turner - who is close to Liberty chairman John Malone - get involved with the team?

"I could see it happening, definitely," said sports business expert Jeff Marks, managing director of Los Angeles-based Sports Business Ventures.

"(Turner's) already struck gold there a couple of times."

Turner owned the Braves until Turner Broadcasting System merged with Time Warner in 1996. Turner was not available for comment. Liberty spokesman John Orr declined comment Friday.

In March 2000, Liberty acquired the hockey Avs, basketball Nuggets and Pepsi Center as part of a $755 million deal for Denver-based Ascent Entertainment Group. Liberty sold the teams and arena four weeks later for $450 million to current owner Stan Kroenke. Liberty reportedly pocketed a profit of $150 million.

Liberty was founded by Malone and has ownership stakes in a wide array of cable-TV programmers and systems.

According to the Atlanta Journal-Constitution, the so-called "cash-rich split off" deal that Liberty and Time Warner are discussing would allow them to avoid or defer taxes.

Liberty would transfer its roughly 100 million shares of Time Warner, worth about $1.7 billion based on Friday's close, to Time Warner.

In return, Liberty would receive the Braves, valued recently at $405 million by Forbes magazine. Liberty would also receive cash from Time Warner to make up the difference between the $1.7 billion and the value that the companies place on the Braves, which could be well above the Forbes estimate.

The Denver Post asked tax expert Robert Wiegand of Greenwood Village-based Wiegand Attorneys and Counselors to discuss what Liberty might do. Liberty would likely put the cash and the Braves into a new subsidiary, he said.

"As long as (Malone) leaves the cash in the company and continues to run that separate business, it's not a taxable transaction," Wiegand said.

If Liberty unloaded the Braves too soon, the Internal Revenue Service would view the sale as "part of the plan" all along and it would be taxed, said Atlanta-based corporate tax expert Frank Crisafi, a partner at law firm Powell Goldstein.

Wiegand said the "cash-rich split off" option has been around since at least the 1950s. Liberty used the tactic before as part of an asset swap with Comcast Corp. in 2004.

During an earnings conference call last week, Time Warner chief executive Dick Parsons said the company is "hopeful" that a deal will be reached.

But there are some obstacles.

A sale of the Braves would require approval from Major League Baseball, league spokesman Pat Courtney said Friday. He declined to comment on the league's stance on the deal.

Some Braves players have voiced concerns about the team being transferred to a company without strong local ties.

"If a guy who has a personal interest in the Braves buys the team, he's more apt to take the money that he makes off the team and put it right back into the team - such as Ted (Turner) did," Braves third baseman Chipper Jones told The Associated Press. "Time Warner didn't do that. Obviously, selling out to (Liberty Media), I don't see things being any different."

Arthur Blank, owner of pro football's Atlanta Falcons and a founder of Home Depot, has expressed interest in acquiring the Braves from Time Warner.

Separately, Liberty is also in "advanced discussions" to sell its 50 percent stake in Court TV to Time Warner.

http://www.denverpost.com/business/ci_3796152

Liberty Media Corp.'s possible jump into sports ownership could last much longer than its foray into the business six years ago when it bought and sold the Colorado Avalanche, Denver Nuggets and Pepsi Center within a month.

The Douglas County-based company is reportedly negotiating to acquire baseball's Atlanta Braves as part of a complex asset swap with the team's owner, Time Warner.

To avoid taxes, Liberty would have to hold onto the Braves for two years, according to corporate tax experts.

If so, it also raises an intriguing question: could former Braves owner Ted Turner - who is close to Liberty chairman John Malone - get involved with the team?

"I could see it happening, definitely," said sports business expert Jeff Marks, managing director of Los Angeles-based Sports Business Ventures.

"(Turner's) already struck gold there a couple of times."

Turner owned the Braves until Turner Broadcasting System merged with Time Warner in 1996. Turner was not available for comment. Liberty spokesman John Orr declined comment Friday.

In March 2000, Liberty acquired the hockey Avs, basketball Nuggets and Pepsi Center as part of a $755 million deal for Denver-based Ascent Entertainment Group. Liberty sold the teams and arena four weeks later for $450 million to current owner Stan Kroenke. Liberty reportedly pocketed a profit of $150 million.

Liberty was founded by Malone and has ownership stakes in a wide array of cable-TV programmers and systems.

According to the Atlanta Journal-Constitution, the so-called "cash-rich split off" deal that Liberty and Time Warner are discussing would allow them to avoid or defer taxes.

Liberty would transfer its roughly 100 million shares of Time Warner, worth about $1.7 billion based on Friday's close, to Time Warner.

In return, Liberty would receive the Braves, valued recently at $405 million by Forbes magazine. Liberty would also receive cash from Time Warner to make up the difference between the $1.7 billion and the value that the companies place on the Braves, which could be well above the Forbes estimate.

The Denver Post asked tax expert Robert Wiegand of Greenwood Village-based Wiegand Attorneys and Counselors to discuss what Liberty might do. Liberty would likely put the cash and the Braves into a new subsidiary, he said.

"As long as (Malone) leaves the cash in the company and continues to run that separate business, it's not a taxable transaction," Wiegand said.

If Liberty unloaded the Braves too soon, the Internal Revenue Service would view the sale as "part of the plan" all along and it would be taxed, said Atlanta-based corporate tax expert Frank Crisafi, a partner at law firm Powell Goldstein.

Wiegand said the "cash-rich split off" option has been around since at least the 1950s. Liberty used the tactic before as part of an asset swap with Comcast Corp. in 2004.

During an earnings conference call last week, Time Warner chief executive Dick Parsons said the company is "hopeful" that a deal will be reached.

But there are some obstacles.

A sale of the Braves would require approval from Major League Baseball, league spokesman Pat Courtney said Friday. He declined to comment on the league's stance on the deal.

Some Braves players have voiced concerns about the team being transferred to a company without strong local ties.

"If a guy who has a personal interest in the Braves buys the team, he's more apt to take the money that he makes off the team and put it right back into the team - such as Ted (Turner) did," Braves third baseman Chipper Jones told The Associated Press. "Time Warner didn't do that. Obviously, selling out to (Liberty Media), I don't see things being any different."

Arthur Blank, owner of pro football's Atlanta Falcons and a founder of Home Depot, has expressed interest in acquiring the Braves from Time Warner.

Separately, Liberty is also in "advanced discussions" to sell its 50 percent stake in Court TV to Time Warner.

http://www.denverpost.com/business/ci_3796152